Here at ITM Platform we often hear PMO professionals say, “our maturity level is too low for PPM” or “we are not ready yet for project management”. In this article, we delve and explore into what project management maturity actually means and how a PPM solution is a bridge and not a roadblock to increasing your maturity level.

Truth is project portfolio management is not just for big corporations or businesses with complex processes.

Regardless of the size or maturity of your operation, it is possible to implement simple and effective project portfolio management. Different maturity levels require different features.

What is “Project Portfolio Management Maturity” anyway?

Project Portfolio Management Maturity refers to how ready your company is to smoothly execute a project, program and portfolio management strategy.

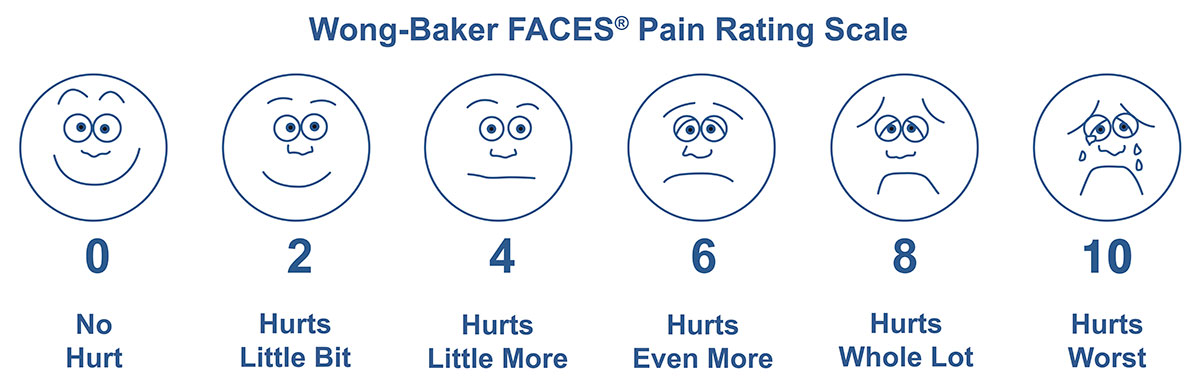

This can be assessed on a wide spectrum, ranging from an individual assessment to applying a formal maturity model assessment.

Identifying your company’s maturity level, yourself

In most cases, companies identify their own maturity levels on their own without any formal assessment. If you´ve ever caught yourself saying, ¨my company isn´t at that maturity level yet¨ then perhaps your own expertise and experience at work has led you to this conclusion. Have you ever had this conversation at the office?

- - Hey, how do you keep track of projects here?

- - We ask the project manager.

- - I see. And do they use any formal or standardized way to do it?

- - Well, so and so do, but not really.

- - Then, how do you know how your portfolio is performing?

- - Eh, we just focus on the projects that are causing problems now.

… Say no more. You´ve already pictured your company as having a low maturity level and reckon a PPM software solution will do nothing more than create confusion and frustration. However, it doesn´t have to be so challenging. Even if you found that the maturity level is low, you can still help your company grow in maturity with the right set of functionalities when applied at the right time.

Applying a maturity model assessment

A maturity model assessment is a specific set of criteria defined for each level and categorizes companies to their respective project portfolio management´s maturity levels.

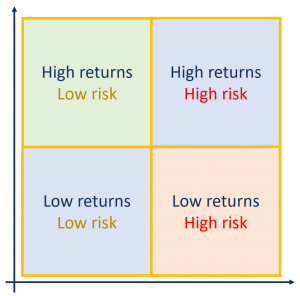

Some models have six levels, others have four or five. But what’s most interesting are the category axes or dimensions that are used for classification. These are the most relevant, explained with basic examples:

- Processes: Consider this the train tracks over which work flows. In our hypothetical conversation above, the fictional you asked about the processes in place. Other examples can be whether the company has formal resource management, risk management, cost management, program management or strategic alignment processes.

You get the idea. If you’re a PMI fan, you already know them all. - People: Maturity models tend to put people first and assess questions like: does the staff understand and embrace project management? Do they know the processes of which they are involved in? Are they use to working on a project-oriented organization rather than a functional organization?

People are vital to any organization and it`s important to consider human resistance when assessing the maturity model of your organization. - Organization: This is where processes and people come together. Some questions about the organizational model usually are: Does your company have a solid PMO (or a PMO at all)? Is Human Resources integrated in the portfolio management? Is top-level management on it? Is it a project-based organization?

Depending on the model, you will commonly come across these axes plus others such as technology or competitive landscape.

The takeaway here is that there are models out there that can help you objectively measure what you already suspected.

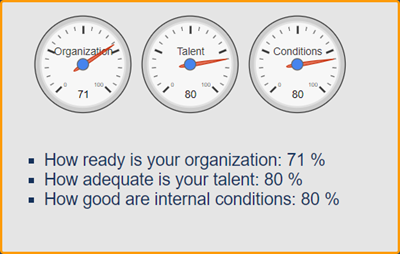

You can also use this online PMO & Organization Self-Assessment that measures three categories: Organization, Talent and Conditions and in return, providing a set of recommendations based on the results.

Our own findings

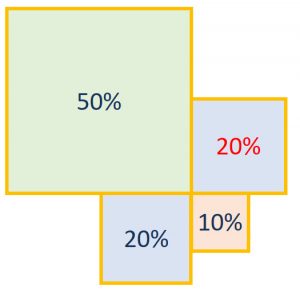

Most companies we´ve talked to find themselves somewhere in the medium-low / medium range spectrum. They tend to assess their company as having a lower maturity level than they actually have.

This happens in all countries we operate in even though there are clear market maturity differences among them. In most cases, this is because companies measure themselves against their own market/countries and not globally.

Furthermore, dealing with leaders across the world, we´ve noticed there is no strong correlation between the company size and its maturity. The general assumption seems to be that big companies are more likely to have a solid PPM methodology in place. However, it’s more related to the nature of the business rather than the size. The more project-oriented the business is, the more mature those organizations tend to be.

How is all this relevant to the decision of implementing a PPM software?

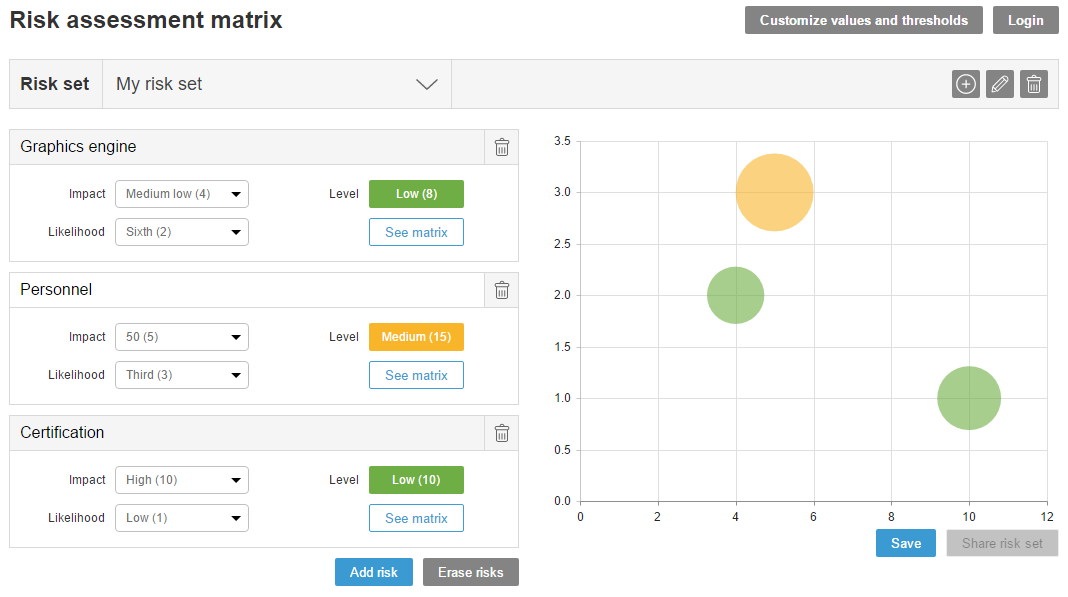

Project portfolio management solutions should be flexible and scalable enough to start small, grow gradually and add processes over time. This will allow you to create a consistent and sustainable project portfolio management ecosystem sans big initial investments and blows to your company.

Logical reasoning would presume: “if my company has a low PPM maturity level, first I need to increase it and then implement the tool”. This obviously happens to those who are aware that there is such a thing as PPM maturity. This persona is usually someone who has either used or has knowledge of complex PPM systems in the past.

And it’s true, six to twelve-month implementations and significant amounts of money are enough to set off any initiative, especially if the organization is not ready. Many would wisely argue that spending more on tools than the ROI they have on their projects is a poor move.

Processes and tools go hand in hand. Implementing one without the other is not ideal, since the tool enables the process and the process is transmitted through the tool. You just need to find the tool that can grow with you and adapt itself on that journey.

Pro tip: Changing from Excel and email to MS Project, then to a collaborative project management solution and finally to a PPM solution is not really growing. It’s breaking and recomposing processes, people and organization at every step of the way.

How ITM Platform supports every level of maturity?

The key is to identify the PPM solution that can provide the features according to your needs. Sound simple? The reality is that optimizing your company´s maturity levels need to take multiple factors into account and is anything but simple. And, like anything else that´s really complicated, most of us are looking for better tools to achieve tasks. Companies need a solution that in tandem adapts to your maturity level and enables you to add or remove features according to your needs.

ITM Platform gently increases maturities with the least possible hassle. It is equipped with easily adaptable features that grow with you no matter the stage. It’s comprehensive, intuitive and its seamlessly easy learning curve is just what you need to get your PMO up and running.

It´s possible to start on the right foot even though you know there’s a low project portfolio management maturity level in your company. And turns out, this is an excellent starting point!

Take the first step and try this free trial now! Experience first-hand what ITM Platform can do for you.

Too much innovation can be bad

Too much innovation can be bad